28 Taxable income band MYR. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar.

Modified Kuppuswamy Scale Psm Made Easy

24 above MYR 600000.

. Income from RM3500001. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. Increase to 10 from 5 for companies.

Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. Country-by-country CbC reporting. Similarly non-resident companies are also taxed at a rate of 24.

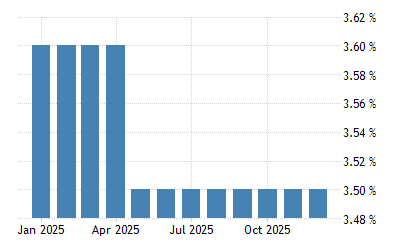

For non-residents in Malaysia the income tax rate ranges from 10 28 for YA 2019. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015.

Income from RM500001. For Sales Tax goods other than petroleum products which are not exempted from Sales Tax or not prescribed to be subject to Sales Tax at the reduced rate of 5 percent. Technical fees payment for services or payment for use of moveable property.

On the First 70000 Next 30000. Company Taxpayer Responsibilities. This page provides - Malaysia Corporate Tax Rate - actual values historical data forecast chart statistics.

On the First 5000 Next 15000. On the First 2500. Apr 14 2022.

Interest paid by approved financial institutions. 10 percent for Sales Tax and 6 percent for Service Tax. 6 rows Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in.

Tax Rate of Company. Effective for YA 2019 Tax relief on net savings in the SSPN is to be increased from RM6000 to RM8000 annually. If the first chargeable income of an SME is RM500000 such a company is charged at a rate of 18.

It should be highlighted that based on the LHDNs website for the assessment year 2020 the max tax rate stands at 30. In 2019 the tax revenue received in Malaysia amounted to approximately 454 billion US. What supplies are liable to the standard rate.

Corporate tax rate for resident small and medium-sized enterprises with capitalization under MYR 25 million 17 on the first MYR 600000. Thats a difference of RM1055 in taxes. Contract payment for services done in Malaysia.

Income from RM2000001. Increase to 5 from 0 for citizens and permanent residents. The fixed income tax rate for nonresident individuals is also increased to 30 percent.

Special classes of income. 20182019 Malaysian Tax Booklet 22 Rates of tax 1. One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable income of more than MYR 2000000.

Increase to 10 from 5 for non-citizens and non-permanent residents. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. In case the income exceeds beyond this limit of chargeable income it is charged at a rate of 24 tax.

Get updates on the current investment climate and find out the latest on withholding taxes indirect taxes and more in this Guide. Income tax rates. Income Taxes in Malaysia For Non-Residents.

Fees are deemed to be derived from Malaysia if the company is resident in Malaysia for the year of assessment. Effective for YA 2019 and YA 2020 Corporate Tax. The income tax rate for SMEs and LLPs on chargeable income of up to RM500000 is to be reduced from 18 to 17.

Tax Rate of Company. Income from RM5000001. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585.

Corporate tax for companies originating in the Territory of Labuan and operating a trading activity in this territory. On the First 35000 Next 15000. The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Chinese summary of investment and tax information prepared and developed by Deloitte Malaysia Chinese Services Group.

The rate of tax for resident individuals for the assessment year 2020 are as follows. 30 Non-residents are subject to withholding taxes on certain types of income. On the First 50000 Next 20000.

The tax rate for 20192020 sits between 0 30. Insights Malaysia Budget 2019. On the First 20000 Next 15000.

Corporate tax standard rate 24. With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased. Rate TaxRM 0 - 5000.

Company with paid up capital not more than RM25 million. If the fees are derived from a country other than Malaysia they are not taxed. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

The CbC Rules require that Malaysian multinational corporation MNC groups with total consolidated group revenues of MYR 3 billion to prepare and submit CbC reports to the tax authorities no later than 12 months after the close of each financial year. Malaysia Residents Income Tax Tables in 2019. Malaysian entities of foreign MNC groups will generally.

Estimating International Tax Evasion By Individuals

Doing Business In The United States Federal Tax Issues Pwc

Why Mauritius Is The 2nd Fastest Growing Wealth Market After China Growing Wealth Wealth Economic Trends

China Loan Prime Rate 5y May 2022 Data 2019 2021 Historical June Forecast

Asia Tire Market Report Commercial Vehicle Marketing Tire

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Irs Tax Return Audit Rates Plummet

10 Things To Know For Filing Income Tax In 2019 Mypf My

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

Company Tax Rates 2022 Atotaxrates Info

There Are Currently Five Bauxite Mines In Australia Providing Feedstock For The Seven Alumina Refineries Which In Turn Supply Alumina Bauxite Export Australia

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

Gst In Malaysia Will It Return After Being Abolished In 2018

Browse Our Sample Of Dividend Payment Voucher Template Dividend Templates Voucher

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

Global Ev Ebitda Energy Environment 2021 Statista

Malaysia Tax Revenue 1980 2022 Ceic Data

How Much Does A Small Business Pay In Taxes